This profit figure is derived after deducting the additional expenses incurred for that dollar during the production. Thus, this unit profit calculated for a product helps firms assess how effective their expenditure is when it comes to the production of goods and items. The cost of goods sold (COGS), or cost of sales, refers to all direct costs and expenses that go towards selling your product.

Unlike gross profit, the gross profit margin is a ratio, not an actual amount of money. However, high prices may reduce market share if fewer customers buy the product. This can be a delicate balancing act, requiring careful management to avoid losing customers while maintaining profitability. Gross profit and gross profit margin will both tell you how successful a company is at covering its production costs. Gross profit helps understand the dollar value of the income that a company brought in.

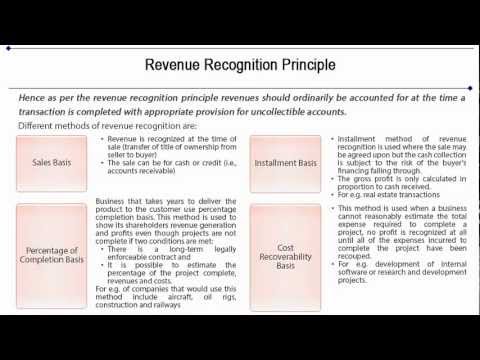

- Revenue is the total money your company makes from its products and services before taking any taxes, debt, or other business expenses into account.

- In other words, it shows how efficiently a company can produce and sell its products.

- In the final part of our modeling exercise, we’ll calculate the total gross profit and gross margin of Apple, which blends the profits (and margins) of both the products and services divisions.

- Banks and investors may ask to see net profits to demonstrate that your company can successfully generate a profit after all costs are accounted for.

Classifying a company’s gross profit as “good” is entirely contingent on the industry that the company operates within and the related contextual details. It also assesses the financial health of the company by calculating the amount of money left over from product sales after subtracting COGS. When the value of COGS increases, the gross profit value decreases, so you have less money to deal with your operating expenses.

How To Calculate Gross Profit

Gross profit is calculated by subtracting the cost of goods sold (COGS) from net revenue. Net income is calculated by subtracting all operating expenses from gross profit. Net income reflects the profit earned after all expenses, while gross profit focuses solely on product-specific costs. It is used to calculate gross profit margin, which is helpful for assessing a company’s production efficiency over time. Compare companies’ gross profit margins within the same industry to identify debt to total assets ratio financial accounting which companies are performing well and which are lagging. Some businesses that have higher fixed costs (or indirect costs) need to have a greater gross profit margin to cover these costs.

Price Increase

Generally speaking, a company with a higher gross margin is perceived positively, as the potential for a higher operating margin (EBIT) and net profit margin rises. On the income statement, the gross profit line item appears underneath cost of goods (COGS), which comes right after revenue (i.e. the “top line”). While gross profit is a useful high-level gauge, companies often need to dig deeper to understand underperformance.

Get in Touch With a Financial Advisor

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. At the end of the year, Garry determines the company’s annual revenue for the year is $850,000. Gross profit is the difference between the amount of sales made during a period and the cost of those sales.

Monica can also compute this ratio in a percentage using the gross profit margin formula. Simply divide the $650,000 GP that we already computed by the $1,000,000 of total sales. Gross profit is an important calculation because it allows businesses to track their production efficiency and profitability over time. Gross profit can also compare a company’s performance against competitors and help businesses decide on pricing and cost-cutting measures. The percentage of gross profit achieved by a company in relation to its total sales. It measures the overall effectiveness of management in relation to production/purchasing and pricing.

To determine gross profit, Garry would subtract COGS ($650,000) from his total revenue ($850,000). For gross profit, he would ignore the administrative costs and salary costs on his company’s income statement. These are fixed costs and, as such, aren’t included in the gross profit formula. High gross profit margins indicate that your company is selling a large volume of goods or services compared to your production costs. Gross profit measures a company’s profitability by subtracting the cost of goods sold (COGS) from its sales revenue. It is usually used to assess how efficiently a company manages labor and supplies in production.

Gross profit margin is useful for tracking changes over time, so businesses can assess how current profits compare to previous quarters. Gross profit is calculated on a company’s income statement by subtracting the cost of goods sold (COGS) from total revenue. It’s important to note that gross profit differs from operating profit, which is calculated by subtracting operating expenses from gross profit.

Hence, the profit metric must be standardized by converting it into percentage form. Monica owns a clothing business that designs and manufactures high-end clothing for children. She has several different lines of clothing and has proven to be one of the most successful brands in her space. In this case, gross profit may indicate that a company is performing exceptionally well, but, when analyzing its profitability, it is important to note that there are also «below the line» costs. This makes net income more inclusive than gross profit and can provide insight into the effectiveness rec-d dictionary definition of overall financial management. The purpose of net income and gross profit are entirely different in terms of determining the success of the company.