Verify that the correct date and amount are entered for each transaction. In case of any discrepancies, double-check the payment and deposit entries to ensure accuracy. The process of clearing undeposited funds in QuickBooks Online involves several important steps to ensure accurate recording and reconciliation of payments. Chances are general and administrative expense you will occasionally receive payments from multiple customers and batch those into one deposit. Posting these payments to the Undeposited Funds account will allow you to correctly record the deposit in QuickBooks Online, making reconciling your bank account easier.

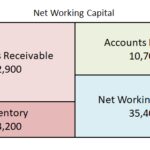

However, the undeposited funds account is an alternative option that can average inventory defined help you keep track of your money at a higher level. Since both transactions were dated on Jan. 29, the first thing to check for is a deposit in your Bank Register for $2,062.52 dated on or around Jan. 29. It’s possible the deposit was posted straight to an Income account rather than matched to payments received. Also check for two separate deposits for $1,675.52 and $387, respectively.

What is the Undeposited Funds Account?

This process involves reconciling the undeposited funds account regularly, which can prevent discrepancies in the financial reports. Unattended undeposited funds may lead to inaccurate financial reporting, which can have detrimental effects on decision-making and overall financial stability. When you put money in the bank, you often deposit several payments at once. For example, let’s say you deposit five US $100 checks from different customers into your real-life checking account. So, you need to combine your five separate US $100 records in QuickBooks to match what your bank shows as one US $500 deposit. By meticulously cross-referencing the deposited amounts with the corresponding invoices and payments, businesses can gain a comprehensive understanding of their financial transactions.

However, the payment will not clear your bank until Jan. 2 of the next year, at the earliest. The importance of this step becomes even more apparent in the next screenshot. As we know, reconciling is an integral part of your books and keeping them accurate. When it comes time to reconcile an account, you have your bank statement in one hand and QuickBooks Online in another. When processing invoice payments through QuickBooks Payments for Desktop, QuickBooks takes care of everything and there’s no need to combine payments or move them to the Undeposited Funds Account. While most of QuickBooks’ features are pretty well-known, some are not talked about as much.

- However, the undeposited funds account is an alternative option that can help you keep track of your money at a higher level.

- See our overall favorites, or choose a specific type of software to find the best options for you.

- You have already received the money, but it hasn’t been deposited in your account yet.

- When you put money in the bank, you often deposit several payments at once.

- This two-step process ensures QuickBooks always matches your bank records.

- Clearing out undeposited funds in QuickBooks Online is essential to ensure accurate financial records and transparency, requiring meticulous attention to pending payments and deposits.

Step 3: Match Deposits to Invoices and Payments

QuickBooks is highly scalable and adapting to the changing business needs. So when it comes to accounting software, QuickBooks can be named ubiquitous. Again, make sure you are selecting Undeposited Funds from the “Deposit To” drop-down menu, and save the transaction. Learn how to put payments into the Undeposited Funds account in QuickBooks Desktop. Using this Undeposited funds feature is going to be an important part of your workflow if you use an external processing service or have some wait time depositing your money. It also aids in maintaining an organized and up-to-date accounting system, which is essential for making informed business decisions and meeting regulatory requirements.

Step 4: Record Any Additional Deposits

This process facilitates the identification of any discrepancies or outstanding payments, contributing to a more streamlined and transparent financial record. Don’t make the mistake of following the steps above and then forget to group your payments when you make your deposit. If you do this, you’ll end up showing your income as double, which of course, can cause problems for you and your company’s books. To see if this has occurred, check the balance in the undeposited funds account against the balance sheet report. Some QuickBooks Online users prefer to post payments straight to their bank accounts rather than using the Undeposited Funds account. When you have your deposit slip, make a bank deposit in QuickBooks to combine payments in Undeposited Funds to match.

Clearing out undeposited funds in QuickBooks Online is essential to ensure accurate financial records and transparency, requiring meticulous attention to pending payments and deposits. Clearing undeposited funds in QuickBooks Desktop involves specific procedures and steps to ensure accurate reconciliation of pending payments and deposits within the desktop software. To begin, access the Banking menu in QuickBooks and select Make Deposits. Then, locate the undeposited funds account and ensure that all payments are properly matched and deposited into the appropriate bank account. It’s important to review each transaction carefully to avoid any discrepancies. Clearing out undeposited funds in QuickBooks involves specific procedures and steps to ensure accurate reconciliation of pending payments and deposits within the software.

By meticulously comparing the records, businesses can pinpoint any undeposited funds, which may have resulted from delayed deposits or unrecorded income. Once you have logged into your QuickBooks Online account, navigate to the ‘Banking’ tab, and then select ‘Make Deposits.’ From here, you can review and select the undeposited funds you want to clear. It’s crucial to ensure that the deposits are matched with the corresponding invoices and payments, as this will accurately reflect the financial transactions. One crucial step is to review the undeposited funds account and ensure that it reflects the correct balance. This involves reconciling the account with the related bank and income accounts to identify any discrepancies. Subsequently, it’s essential to adjust the undeposited funds settings to streamline the deposit process and prevent it from accumulating balances the difference between a w2 employee and a 1099 employee over time.

Start using the Undeposited Funds account

Have you ever been in your Chart of Accounts and noticed Undeposited Funds? It’s possible that you’ve seen it many times without knowing much about it, or when you should use it. Well, get ready to learn something new and take a thorough look at Undeposited Funds.