To obtain a cash payout before the note reaches maturity, you can sell these notes to a bank or other financial institution for some price below the note’s face value. A contra revenue represents any deductions or offsets that need to be removed from gross revenue to provide a clearer understanding of actual income — such as in the example just provided. These accounts will typically help track sales discounts, product returns, and allowances (e.g., a price reduction for a good with minor defects). Contra asset accounts are presented on the balance sheet as reductions from the asset accounts they relate to.

Contra accounts definition

Accruing tax liabilities in accounting involves recognizing and recording taxes that a company owes but has not yet paid. This is important for accurate financial reporting and compliance with… Similarly, if the parent account lists entries as debits, the contra account will appear as a credit. And why stop at just theory when you can apply what you’ve learned using premium templates?

What is a Contra Account? Definition

If a customer returns a product, the ‘Sales Returns’ contra revenue account lowers the total sales revenue, reflecting the true income. Contra asset examples like ‘Accumulated Depreciation’ reduce the value https://www.instagram.com/bookstime_inc of fixed assets, showing their worth after usage over time. Contra liability, equity, and revenue accounts have natural debit balances. These three types of contra accounts are used to reduce liabilities, equity, and revenue which all have natural credit balances.

- Taking the example of CCC again, the company has $50,000 in accounts receivable at year-end of December 31.

- There is the existence of contra accounts in accounting which are accounts that have the purpose of decreasing the value of another specific account if the two accounts are netted or summed together.

- Then, when the employee-paid portion of the expense is paid to the company by employees, these reimbursements are recorded in a benefits contra expense account.

- Companies like to depreciate assets as quickly as possible to get the tax savings, so the balance sheet may not state the true value of fixed assets.

- The revenue contra accounts Sales Returns, Discounts and Allowances are subtracted from the main Sales Revenue account to present the net balance on a company’s income statement.

How to Record a Contra Account

- The difference between an asset’s account balance and the contra account balance is known as the book value.

- Millions more were earmarked for “commissions” for the participants, including himself, although he insisted that he had received no money.

- After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

- The initial receipt and the subsequent deduction are both logged, revealing the net effect of the transaction without distorting the total income.

- The equity section of the balance sheet is where the shareholder’s claims to assets are reported.

- Maybe more importantly, it shows investors and creditors what percentage of receivables the company is writing off.

For example, if a piece of heavy machinery is purchased for $10,000, that $10,000 figure is maintained on the general ledger even as the asset’s depreciation is recorded separately. Contra expense accounts are indispensable tools in financial analysis, offering a nuanced lens through which analysts can assess a company’s cost management strategies. By providing a more accurate depiction of net expenses, these accounts enable analysts to delve deeper into the efficiency of a company’s operations. This deeper insight is particularly valuable when comparing financial performance across different periods or against industry benchmarks. Inscrutable Corporation offers long-term disability insurance to its employees under an arrangement in which it pays for the insurance, and then participating employees reimburse it for half of this cost. In the first month of the arrangement, the company pays the insurer $10,000, which Inscrutable records in a long-term disability insurance expense account.

Contra Account Definition, Types, and Example

- Contra expense accounts are indispensable tools in financial analysis, offering a nuanced lens through which analysts can assess a company’s cost management strategies.

- For a liability or revenue account that are naturally credit accounts, the contra accounts will be in a debit position.

- Contra accounts are confusing at first, but, with a little study, understanding them becomes second nature.

- When the account receivable is written off, it is added to bad debt expense on the income statement and placed in the contra account.

- Examples of deferred unearned revenue include prepaid subscriptions, rent, insurance or professional service fees.

If every single buyer had taken advantage of the early payment discount, the company would have provided roughly $5 thousand in discounts during that same timeframe. In reality, the actual number of company discounts came closer to $2 thousand. Optimizing your handle on contra accounts doesn’t end with just understanding them; it’s about mastering the tools and techniques to manage them effectively. Enrich your expertise by diving into online courses that dissect advanced accounting concepts, many of which come with coveted CPE credits to boot.

How to Calculate Straight Line Depreciation

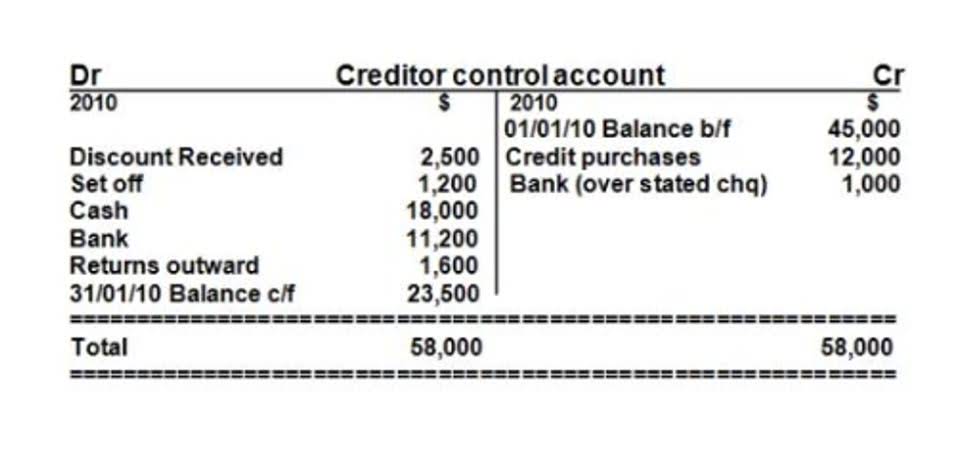

For a liability or revenue account that are naturally credit accounts, the contra accounts will be in a debit position. Therefore, to ensure accounts receivable stays clean and transparent, CCC will record $2,500 in the contra asset account called “Allowance for Doubtful Accounts”. This will ensure the net value of accounts contra expense receivable at year-end is not overstated.

Contra Account Example: Allowance for Doubtful Accounts

Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. From 1962 to 1965, as a young aviator, Secord achieved https://www.bookstime.com/articles/zoho-books one of the best records of the Vietnam War. In 1963, he was assigned to Iran and trained pilots for the Shah of Iran’s air force. The parents divorced in 1946, and Wahneta Secord moved her children to Columbus, about 60 miles south of LaRue.